Four good bank offers have come out over the past week or so, as reported by Doctor of Credit. Each offer allows you to earn $500 or more. They represent a fairly easy way to add to your financial bottom line.

Here’s an overview of each of the four offers, together with my recommendation for which one(s) to get, depending on your circumstances:

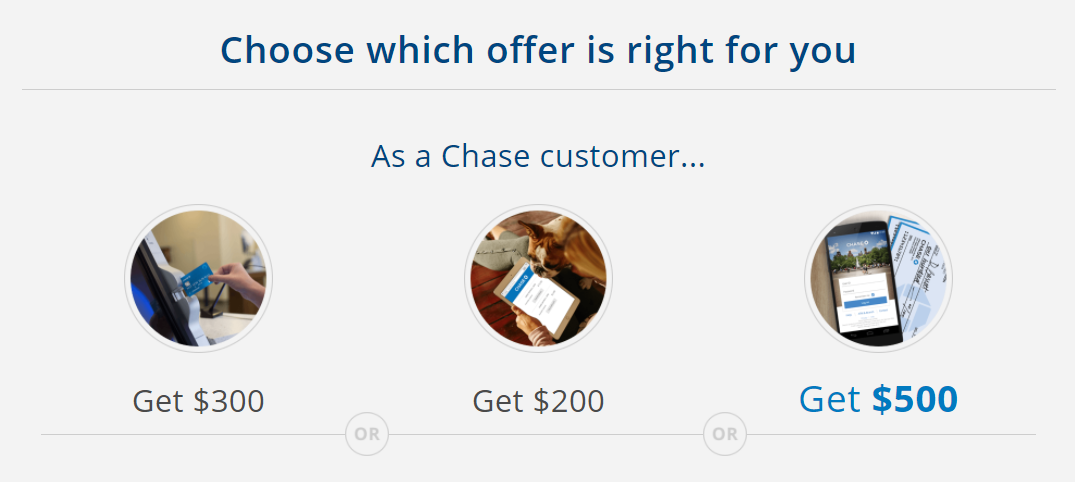

1) Chase $500 Offer: $300 Checking + $200 Savings

Now through June 15, 2017, you can get bonuses by opening a Chase checking account, savings account, or both. My wife and I have successfully done these bonuses in the past. I covered the basics of bank bonuses such as these in this post.

To be eligible for these bonuses, you can’t already have a like account open, nor can you have closed a like account within the past 90 days. You can get each bonus only once per calendar year.

These bonuses are considered interest and are taxed accordingly.

1a. Chase Checking $300 Bonus

Get a $300 bonus by opening a Chase Total Checking account. Here’s how:

- Click here to get a coupon code from Chase. Do this step now as coupon codes may run out.

- Open the account by June 15. The account must be opened in branch. Remember to bring the coupon with you.

- Make an initial deposit of at least $25.

- Make a direct deposit into the account within 60 days. Standard means of direct deposit include paycheck, pension, or government benefits. For a list of other means of direct deposit that have worked in the past, see this Doctor of Credit post.

- The bonus will appear within 10 business days of meeting the requirements.

- The account has a monthly fee of $10-12. That fee is waived if you do any one of the following:

- Have monthly direct deposits totaling $500 or more.

- Maintain a minimum daily balance of at least $1,500.

- Or maintain an average daily balance of at least $5,000 across qualifying Chase checking and savings accounts.

- Keep the account open at least six months. Otherwise, Chase will claw back the bonus.

My recommendation: This is a great bonus with minimal requirements. As long as you can initiate a direct deposit and keep the account fee-free using one of the methods mentioned above, you should seriously consider it. That is even more true if you’re able to do the following bonus at the same time.

1b. Chase Savings $200 Bonus

Here’s how to get a $200 bonus on a Chase Savings account:

- Click here to get a coupon code from Chase. Do this step now as coupon codes may run out.

- Open the account by June 15. The account must be opened in branch. Remember to bring the coupon with you.

- Deposit at least $15,000 of new money within 10 business days.

- Maintain a balance of at least $15,000 for 90 days.

- The bonus will appear within 10 business days of meeting the requirements.

- The account has a monthly fee of $5. That fee is waived if you do one of the following:

- Keep a minimum daily balance of at least $300.

- Or have at least one recurring automatic transfer of at least $25 from your Chase checking account.

- Keep the account open at least six months. Otherwise, Chase will claw back the bonus.

My recommendation: I probably wouldn’t do this bonus by itself. But if you’re already doing the checking bonus, and if you have $15,000 to park in this savings account for three months (and $300 to park in the account for the 3 months after that), it’s probably worth doing.

2) Northpointe 5% Interest Checking Account on up to $10,000

The UltimateAccount from Northpointe Bank pays 5% interest per year on balances up to $10,000. That’s up to $500 per year in interest.

The UltimateAccount from Northpointe Bank pays 5% interest per year on balances up to $10,000. That’s up to $500 per year in interest.

Northpointe also reimburses you on qualifying ATM fees up to $10 per month. Northpointe is FDIC insured.

Here’s how to get this deal:

- Open an account online by clicking here.

- Make an initial deposit of at least $100 via ACH transfer or credit card.

- Enroll in eStatements.

- Ensure that at least 15 debit card purchases post and settle each statement period.

- Set up direct deposit or automatic withdrawal of $100 or more each statement period.

My recommendation: If you’re looking to just park $10,000 somewhere, this is not a great option because of the activity requirements. If, however, you would consider using the account as your primary checking account, it is excellent. In that case, you not only get 5% interest—up to $500 per year—but qualifying ATM fees are reimbursed up to $10 per month.

3) 5Star Bank 2% Interest Checking Account on up to $25,000

5Star Bank is offering 2% interest on up to a $25,000 balance with their Kasasa Cash Checking account. That’s up to $500 per year in interest.

5Star Bank is offering 2% interest on up to a $25,000 balance with their Kasasa Cash Checking account. That’s up to $500 per year in interest.

5Star Bank reimburses you on qualifying ATM fees up to $20 per month. 5Star is FDIC insured.

Here’s how to get this deal:

- Open an account online by clicking here.

- Make an initial deposit of at least $50.

- Enroll in online banking and log in once per statement period.

- Enroll in eStatements.

- Ensure that at least 12 debit card purchases post and settle each statement period.

My recommendation: This opportunity is very similar to the Northpoint offer above. If you can only do one of them, I’d recommend the Northpoint one as you can earn $500 per year on just $10,000 deposited, whereas you have to deposit $25,000 with 5Star to earn $500 per year. But if you have $35,000 to invest, you could do both deals and earn $1,000/year on that $35,000 for a blended APY of 2.86%.

4) BankPurely 1.3% Interest Savings Account with no Maximum Deposit

BankPurely is offering 1.3% interest on any amount deposited with no maximum. As far as I am aware, that’s the best uncapped APY you can earn on a basic savings account.

BankPurely is offering 1.3% interest on any amount deposited with no maximum. As far as I am aware, that’s the best uncapped APY you can earn on a basic savings account.

BankPurely will plant a tree for every SavingPurely account that is opened. BankPurely is FDIC insured.

Here’s how to take advantage of this offer:

- Open an account online by clicking here.

- Make an initial deposit of at least $1.

My recommendation: If you’re willing to engage in some shenanigans, the three previous offers will earn you more bang for the buck than this one. With this 1.3% APY offer, you’d have to have $38,462 on deposit to earn the same $500 you could earn with any of the three above offers. That said, this account is attractive owing to its utter simplicity and best-in-class rate of return.

You might consider it under the following conditions: Your current savings account is paying you one one-hundredth as much, which is possible. Or you’re sitting on a lot of cash that you want to park in a savings account. Or you are doing offers 1, 2, and 3 above and are looking for a savings account for additional money you have.

Conclusion

These are the best nationwide bank account opportunities I’ve seen this year. While from the perspective of timing it would be nice if they were spread out a bit, at least this way you have multiple options to consider and choose from.

If you’re new to bank deals, you should think about getting your feet wet by opening at least the Chase checking account.

You won’t get rich by taking advantage of deals like these. That said, you can easily earn $500 with 5 or few hours of effort. Earning $100/hour or more is a great deal unless you make more than $200,000/year.

Question: What questions do you have about bank offers in general or these four offers in particular? You can leave a comment by clicking here.

If you liked this post, why not join the 5,000+ subscribers who receive blog updates on how to have more time and money for what matters most? Sign up here.