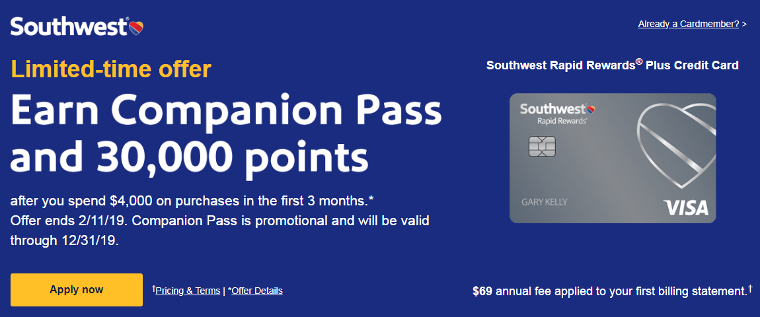

As widely reported by travel bloggers, Southwest is offering an unprecedented signup bonus on the personal versions of the Southwest credit card. Specifically, from now through February 11, you can earn 30,000 Southwest miles and the Companion Pass by opening just one credit card.

The Southwest Companion Pass is arguably the best deal in travel. It allows a companion to fly for free with you on any Southwest flights you book. This version of the pass is good from the time you earn it until the end of 2019.

Knowing that I love the Companion Pass, a reader reached out to ask my thoughts.

Although it has never been possible in the past to earn the Companion Pass with such ease, is it a good deal? That depends. For some, it’s a terrific deal. For others, it’s not. Here’s how to decide if it’s a good deal for you: