You’ve probably seen commercials advertising credit cards that earn 5% cash back or 5 points per dollar spent. Compared with standard cards that often earn just 1% cash back or 1 point per dollar spent, these 5x cards seem amazing. But are they? Should you get them?

In this post I’ll cover the 4 main cards that earn 5x rewards. I’ll then provide my recommendation for whether to get them.

How these 5x Credit Cards Work

The four cards I cover in this post give you 5% cash back or 5 points per dollar spent (depending on the card) in certain categories each quarter of the calendar year. Categories range from gas stations to grocery stores to movie theaters. Each card caps how much qualifying spend you are allowed to earn 5x on.

For instance, a card may give you 5% back on up to $1,500 spent on groceries during a particular quarter. If you spend $1,500 on groceries that quarter, you will earn $75 cash back. If you only spend $300 on groceries that quarter, you will earn $15 cash back. Etc.

4 Cards with 5x Categories

Here are the four main 5x cards and how they function:

Discover It

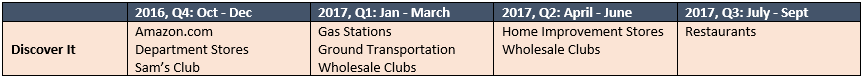

The Discover It card gives you 5% cash back on up to $1,500 of spend in select categories each quarter of the calendar year. It comes with a signup bonus of $50 after your first purchase within 3 months of opening the card.

For this upcoming quarter (July – Sept, 2017), there is just one 5x category: restaurants.

Here’s a snapshot of all the categories offered on the card over the one-year time period running from 10/1/16 to 9/30/17:

Chase Freedom

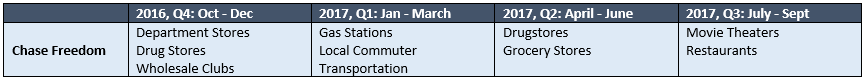

The Chase Freedom card functions the same way as the Discover It card, giving you 5x back on up to $1,500 in spend in select categories each quarter. The difference is that it doesn’t award you cash back but rather Chase Ultimate Rewards points (URs). If you value URs more highly than 1 cent/apiece, as I do, earning 5 URs per dollar is better than earning 5% cash back.

The card comes with a signup bonus of 15,000 URs (worth $150 or more) after spending $500 on the card within the first 3 months of account opening. Because of its signup bonus and potentially more valuable points, the Chase Freedom is my favorite of the 5x cards.

Here are the categories offered on the card over the past year:

Citi Dividend

Whereas Chase and Discover only pay out 5x on $1,500 of bonus category spend per quarter, the Citi Dividend card works differently. It pays out 5x on select categories on up to $6,000 of spend per calendar year. It therefore provides more flexibility in allowing you to concentrate your 5x-bonused spend in quarters where the categories are more appealing to you.

The categories that qualify for the 5x bonus still change each quarter. Here are one year’s worth of categories:

The Citi Dividend card is no longer available to new applicants. But if you already have a different Citi card, you may be able to “product change” from the card you have to the Citi Dividend card. You won’t receive any kind of bonus for getting the card.

U.S. Bank Cash+

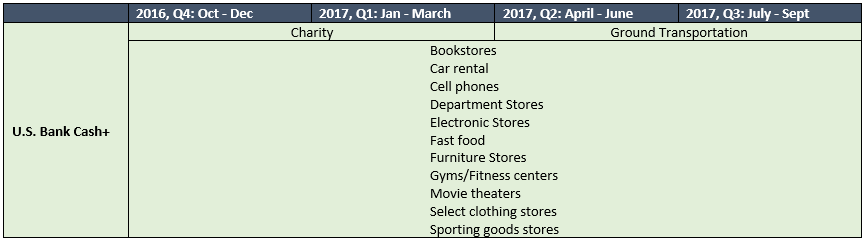

The U.S. Bank Cash+ card awards 5% cash back in two categories of your choice on up to $2,000 of spend each quarter.

The categories typically don’t change. The one recent exception is that U.S. Bank replaced the “charity” category with “ground transportation”:

There is no signup bonus for opening the Cash+ card.

3 Reasons Most People Shouldn’t Apply for these 5x Cards

Now that you have a sense of how these cards work, I want to make the case that for most folks they aren’t worth applying for. Here’s why:

- Best-case Scenario not as Good as Other Opportunities. In the best-case scenario, you open the Chase Freedom Card and get the $150 signup bonus. You then spend $1,500 on the card each quarter in 5x categories. Doing so earns you $75 per quarter, i.e. $300 per year. Earning $450 total in the first year isn’t bad. But you’d be better off opening a credit card with a huge sign up bonus. After all, there are 32 cards on my Best Credit Card Signup Offers page that provide more than $450 of first-year net benefit. 13 of them provide more than $800 of first-year net benefit.

- Best Case Scenario Unlikely. What’s worse is that the best-case scenario is not likely. That’s because it is extremely unlikely that you will be able to max out the available 5x bonus each quarter. (Unless you undertake the sort of “5x hacking shenanigans” I reference below.) Pick a card from above and look at the bonus categories for each quarter. Let’s say you think you’d be able to spend $1,500 in Q1 bonus categories, $300 in Q2, $0 in Q3, and $500 in Q4. In that case, you would earn 5x on $2,300 worth of purchases in one year. That works out to a $115 bonus (5% of $2,300). That is much lower than the “best-case scenario” bonus of $300 pear year (or $400 per year with the Cash+ card).

- Opportunity Cost of Time. Finally, as I’ve argued before, it is critical when assessing a deal to factor in the value of your time. With these cards, you need to activate the 5x bonus each quarter. When making purchases, you also need to remember to pull out the relevant 5x card. In a vacuum, doing so is probably worth the money you might save, despite it being a hassle. The bigger issue is that your limited time is better spent on more highly-leveraged earning opportunities like earning credit card signup bonuses or bank account bonuses.

2 Situations when these 5x Cards do Make Sense

For the above reasons, I don’t think most folks should apply for these 5x cards. That said, the cards make much more sense for folks in these scenarios:

- Downgrading. Let’s say you sign up for a Chase or Citi card with a huge signup bonus. Then, before the annual fee comes due on that card, you downgrade that card to the Chase Freedom or Citi Dividend card, respectively. In that case, because you aren’t applying for a new card, your credit won’t be checked. No “hard inquiry” will be registered on your credit report. Hard inquiries are often worth incurring for the sake of getting a card with a huge signup bonus, as I discuss here. But I wouldn’t generally recommend registering a hard inquiry for a card with no signup bonus or only a small one, as is the case for these 5x cards. In short, “product changing” to a 5x card makes sense in a way that applying for one of these 5x cards does not.

- Maximizing Category Spend. Obviously, if you can maximize the allowable amount of spend in these categories—if you can achieve the “best-case scenario” described above—then you could earn upwards of $400 cash back each year. That’s a decent chunk of change in itself. What’s more, you could earn that same amount year after year without having to open a new card. For most people, to achieve this best-case scenario, you will have to do some “hacking” shenanigans. I’ll send you those hacks by email if you’re interested:

{{Privy:Embed campaign=244837}}

Bottom Line

On balance, I don’t think most people should apply for these cards. Instead, I’d suggest applying for the most lucrative cards on my Best Credit Card Signup Offers page.

If, however, you can downgrade to these cards, or if you already have one or more of them (as I do), then I do think it makes sense to use them whenever possible to earn 5x.

Question: Have you seen these cards advertised and wondered about them? Or if you have one, how often do you use it? You can leave a comment by clicking here.

If you liked this post, why not join the 5,000+ subscribers who receive blog updates on how to have more time and money for what matters most? Sign up here.